Simple teflon coating boosts hydrogen production efficiency by 40%

Simple teflon coating boosts hydrogen production efficiency by 40%

A common non-stick coating used in cookware has been shown to enhance hydrogen production efficiency in water electrolyzers by approximately 40%. The key innovation involves applying a specialized coating to critical components to prevent hydrogen bubbles from adhering, thereby enabling smoother hydrogen release.

How the coating improves efficiency

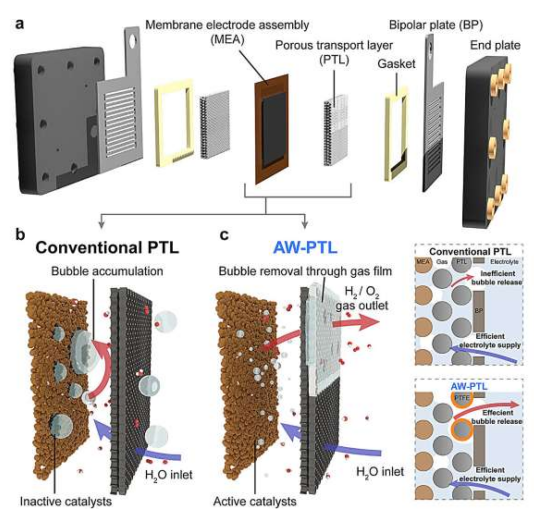

Led by Professors Jungki Ryu and Dong Woog Lee from the School of Energy and Chemical Engineering at UNIST, the research team achieved a substantial performance improvement through a simple spray coating polytetrafluoroethylene (PTFE), widely known as Teflon, onto the porous transport layer (PTL), a vital component of water electrolyzers. The study is published in the journal Advanced Science and was chosen as a cover article.

Water electrolyzers produce hydrogen by splitting water molecules using electricity. During operation, hydrogen forms on the catalyst surface of the electrodes. However, when hydrogen bubbles stick to the catalyst, they block active sites and hinder the reaction, leading to reduced efficiency due to a decrease in accessible catalyst surface area.

To address this, the team coated the PTL—a component that helps transport hydrogen and water—with PTFE. Commonly used to make non-stick cookware, PTFE was applied via a simple spray coating. This coating prevents hydrogen bubbles from adhering to the porous structure, allowing them to escape easily and keeping the reaction running smoothly.

Design choices and practical results

Importantly, the researchers coated only the top half of the PTL, leaving the bottom part uncoated. Since the PTL also supplies water to the catalyst, limiting the coating to the top part ensures water flow remains unobstructed while hydrogen bubbles are efficiently expelled through the coated section. This design maintains water supply and enhances hydrogen removal simultaneously.

The results were remarkable, as the electrolysis cells with the coated PTL exhibited a 40% increase in current density compared to uncoated cells, thereby indicating higher hydrogen production rates. Additionally, the voltage increase typically caused by hydrogen bubble buildup was notably reduced, further boosting overall efficiency.

The coating process is simple and scalable, involving just spray application followed by heat treatment—no complex nanofabrication or elaborate manufacturing steps are required. The team successfully demonstrated coating large-area PTLs up to 225 cm², proving its practicality for real-world applications.

Professor Ryu commented,

While it is generally believed that increasing the hydrophilicity of the PTL improves water supply and efficiency, our findings show that a hydrophobic PTFE coating can actually enhance hydrogen removal and overall performance.

Professor Lee added,

Teflon is a well-known and widely available material, making this approach easy to adopt.

”Since the existing electrolysis systems remain unchanged, applying this coating is straightforward. Beyond water electrolysis, this method could also benefit other electrochemical systems that involve gas evolution, such as fuel cells and metal-air batteries.”

Source: Hydrogencentral